Solutions for every step

of the investor journey

Our solutions package investing and advisory best practices as easy-to-use services & APIs.

portfolio fetcher

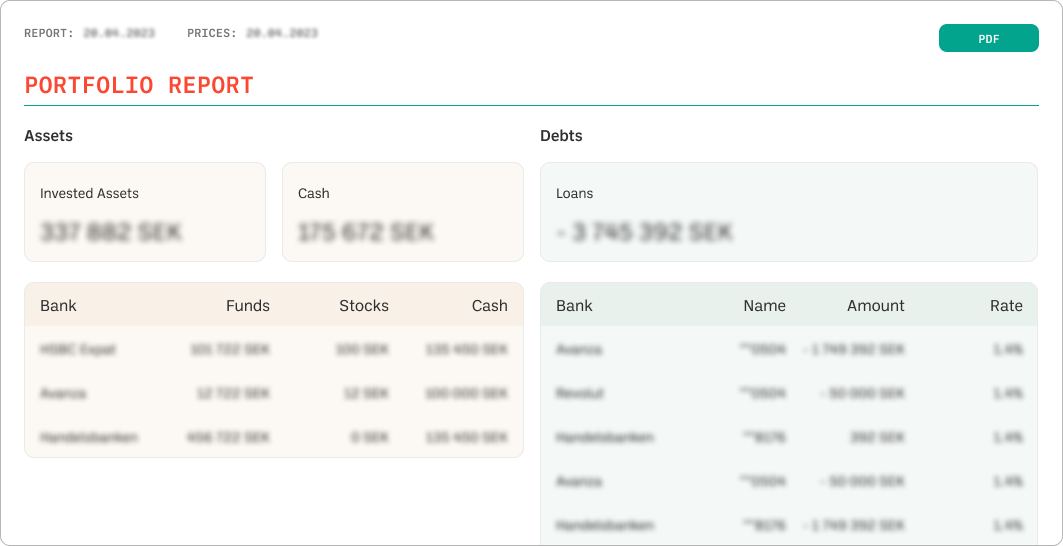

The Portfolio Fetcher helps financial advisors collect and analyze information about all client's assets and loans. It delivers data-driven insights, unlocks hidden opportunities, and enhances client communication.

automatically collects client’s data

Data from the Portfolio Fetcher gives you a complete picture of the client’s financials.

Cash and savings accounts

Investments

Company pensions

Mortgages

Analytics

Helps find insights and give better advice.

Current market value

Allocation by asset class, sector and geography

Risk and expected return

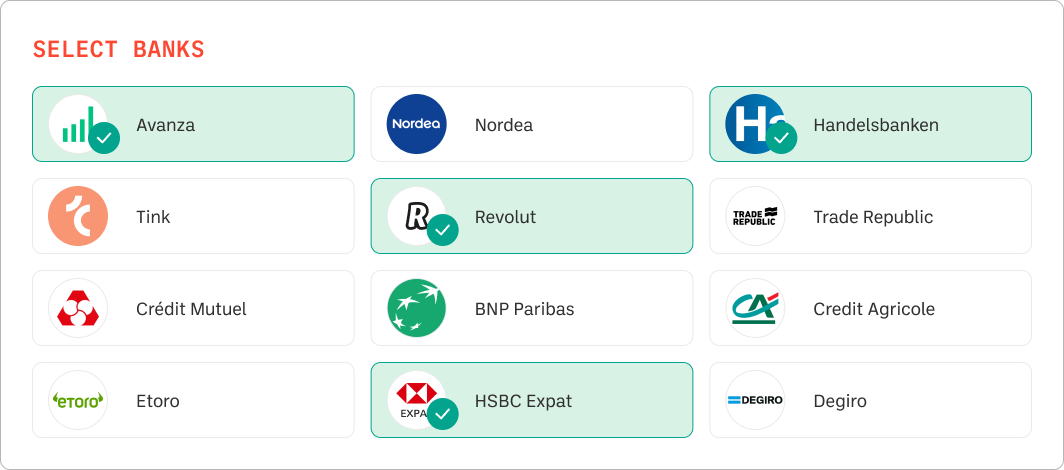

Full overview in 2 minutes

1. Client selects banks and authenticates.

2. Advisor gets a report with holdings and analysis.

Financial analytics & API

Deliver a great investing experience and extract real value from Open Finance data with Njorda API

and analytics.

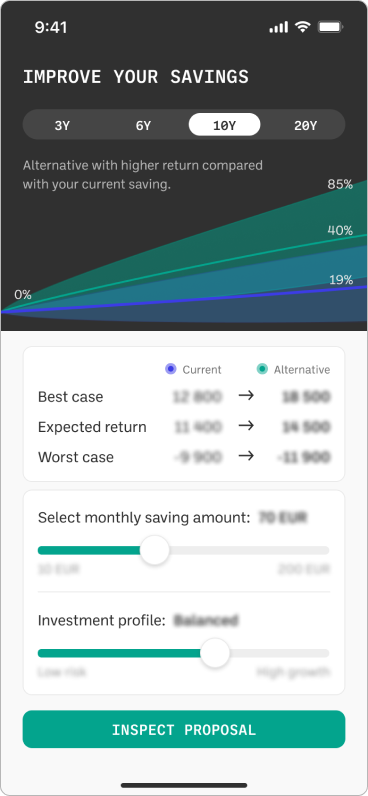

Saving & investment analytics

We have a complete set of API-accessible portfolio analytics to boost internal development and standalone services.

Performance

Track investments, break down P&L, drop-in charts.

Goal setting

Set and track goals.

Risk & return

Calculations and future scenarious for current or prospective portfolio.

Smart notifications

Let clients or advisors know when the market has moved and the action is needed.

Njorda Connect — Open Finance

Njorda works with both in-house data and external holdings using open finance data. Let clients connect accounts at other institutions to get a complete picture of their finances.

Support for multiple aggregation technologies

Risk and expected return

Normalize data and provide a unified, easy-to-use API

Our customers

Book a demo

30 minute no commitment demo of our solution.

With Njorda, you can quickly develop a great digital savings and investing offer.

We deliver apps and APIs so retail investors can: